Loan Programs

Loans Are Financial Aid That Must Be Repaid

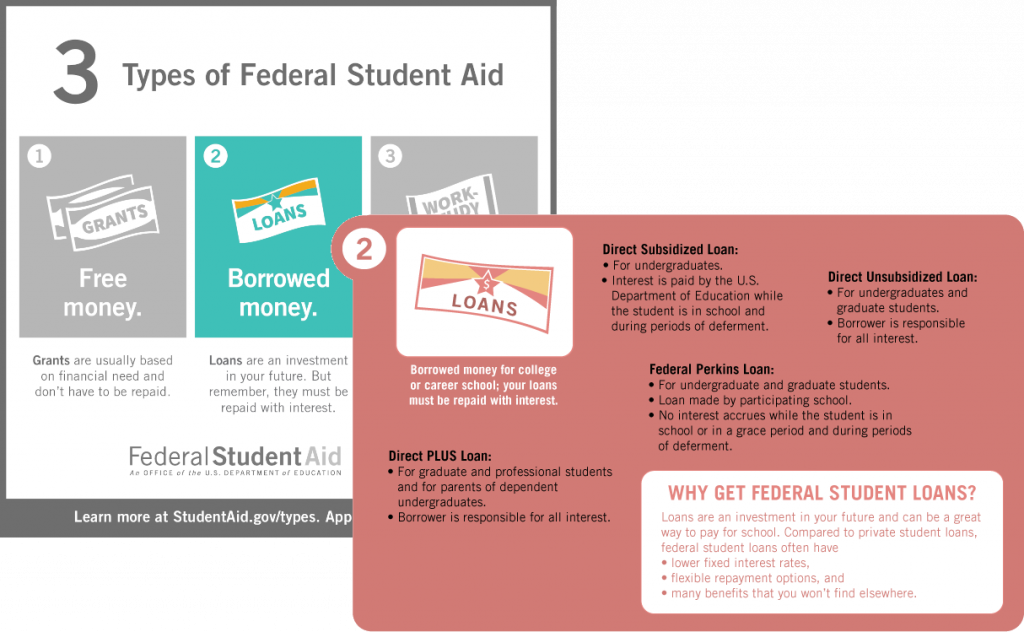

Federal Direct Loans

Federal Direct Subsidized and Unsubsidized Loans

Federal Student Loan Basics for Students

Préstamos Federales para Estudiantes Conceptos Básicos para Estudiantes

您的最高直接贷款资格在您就读的每个机构都是相同的。根据你在每个学校的估计需求,它可能会有不同的内容,但你总是有相同的,最高资格。

The Federal Direct Loan Program has both a need based,subsidized, component and a non-need based,unsubsidized, component.

The DirectSubsidizedLoan is a loan based on financial need for which the federal government generally pays the interest that accrues while the borrower is in an in-school, grace, or deferment status.

The DirectUnsubsidized贷款是指借款人完全负责支付利息的贷款,无论贷款状况如何。无补贴贷款的利息自发放之日起计算,并在整个贷款期限内持续。利息的支付将被延迟,但可以选择在学校期间支付。This type of loan is not based on financial need.

Direct Loan interest and principal payments are automatically deferred during school (while students are attending at least half-time) and through the student’s six month grace period. Direct Loan interest rates are fixed each year by law and may vary from award year to award year. Direct Loan award amounts are based on a student’s class level and dependency status, need, and aggregate borrowing. Students who elect to borrow under the Federal Direct Loan program must complete aMaster Promissory Note(MPN), and first-time borrowers must completeEntrance Counseling. To complete your Direct Loan MPN, Entrance Counseling, or Annual Student Loan Acknowledgment, go to:studentaid.gov.

(NOTE:如果您获得了2012年7月1日至2014年7月1日期间首次支付的直接补贴贷款,您将负责支付宽限期内产生的任何利息。)

Annual and Aggregate Limits for Federal Direct Subsidized and Unsubsidized Loans

Page 3-98 of Chapter 5 of Volume 3 of the FSA HB, Dec 2018 (PDF)

Federal Direct Parent Loan for Undergraduate Students (PLUS)

Direct PLUS Loan Basics for Parents

Conceptos básicos sobre préstamos PLUS del Direct Loan Program para padres

The Federal Direct Parent PLUS Loan is available to parents of dependent, undergraduate students for their educational expenses. Parents may borrow up to the difference between the student’s estimated cost of attendance and the other financial assistance that the student is expecting for the year. Parents who want to borrow under the PLUS loan program must apply for credit [after May 1 of each year] from the U.S. Department of Education atstudentaid.gov. Once the parent borrower’s credit is approved, the parent borrower mustcompleteor have an active PLUS Master Promissory Note (MPN) on file with the Department, submit to EOU’s Financial Aid Office thePLUS Acceptance Form,学生在支付前需要在他或她的学生门户网站(即骑警中心)接受贷款。

一般来说,PLUS贷款的还款在学年最后一次支出后开始,但可以延期,每次支出后立即开始产生利息。Students who have had a parentdeniedduring the PLUS approval process, or who do not meet the eligibility requirements (e.g. noncitizen parents) are eligible to borrow additional funding in the Federal Direct Loan program (submit aLoan Revision Request表格交到经济援助办公室)卡塔尔世界杯比赛对阵表。除非另有指示,否则由收到PLUS贷款资金而产生的学生帐户上的信用余额将直接邮寄给家长借款人。

Federal Direct Graduate PLUS Loan

The Federal Direct Graduate PLUS loan is offered to students enrolled in a graduate or professional degree program to cover the gap between a student’s estimated cost of attendance and their estimated financial assistance. Students who want to borrow under the Graduate PLUS Loan program must first pass a credit check atstudentaid.gov. Students who have been approved must then complete a Graduate PLUS Master Promissory Note (MPN). Students should borrow their full Unsubsidized Direct Loan maximums before applying for the Federal Direct Graduate PLUS loan. For additional questions on this program please contact the Financial Aid Office or visitstudentaid.gov.

Federal Direct Loan Interest Rates and Loan Fees

Federal Direct Loan Interest Rates

| Loan Type | Student Level | 2022-2023 Interest Rate |

|---|---|---|

| Subsidized | Undergraduate | 4.99%, fixed |

| Unsubsidized | Undergraduate | 4.99%, fixed |

| Graduate | 6.54%, fixed | |

| PLUS | Parent | 7.54%, fixed |

| Graduate | 7.54% fixed |

| Loan Type | Student Level | 2021-2022 Interest Rate |

|---|---|---|

| Subsidized | Undergraduate | 3.73%, fixed |

| Unsubsidized | Undergraduate | 3.73%, fixed |

| Graduate | 5.28%, fixed | |

| PLUS | Parent | 6.28%, fixed |

| Graduate | 6.28%, fixed |

How Interest Rates are Determined….

Direct Subsidized Loans, Direct Unsubsidized Loans, and Direct PLUS Loans first disbursed on or after July 1, 2013 have fixed interest rates that are determined in accordance with formulas specified in sections 455(b)(8)(A) through (C) of the Higher Education Act of 1965, as amended (HEA).

The interest rate is determined annually for all loans first disbursed during any 12-month period beginning on July 1 and ending on June 30, and is equal to the high yield of the 10-year Treasury notes auctioned at the final auction held before June 1 of that 12-month period, plus a statutory add-on percentage that varies depending on the loan type and, for Direct Unsubsidized Loans, whether the loan was made to an undergraduate or graduate student. Loans first disbursed during different 12-month periods may have different interest rates, but the rate determined for any loan is a fixed interest rate for the life of the loan.

For each loan type, the calculated interest rate may not exceed a maximum rate specified in the HEA. The maximum interest rates are 8.25% for Direct Subsidized Loans and Direct Unsubsidized Loans made to undergraduate students, 9.50% for Direct Unsubsidized Loans made to graduate and professional students, and 10.50% for Direct PLUS Loans made to parents of dependent undergraduate students or to graduate or professional students.

Seestudentaid.gov为更多的信息。

Federal Direct Loan Fees

| Loan Type | Loan Fee |

|---|---|

| Direct Subsidized and Unsubsidized | 1.057% |

| PLUS | 4.228% |

| Loan Type | Loan Fee |

|---|---|

| Direct Subsidized and Unsubsidized | 1.057% |

| PLUS | 4.228% |

Sequester-required loan fees and grant reductions for FY 23

Federal Loan Servicer Information

Please点击这里有关联邦贷款服务机构的信息。

Private (or alternative) Student Loans (i.e.notFederal)

Generally, there are two types of student loans—federal and private.

Federal student loans and federal parent loans: These loans are funded by the federal government with terms and conditions that are set by law, and include many benefits (such as fixed interest rates and income-driven repayment plans) not typically offered with private loans.

Private student loans字体这些贷款是非联邦贷款,由贷方(如银行、信用社、州机构或学校)发放,其条款和条件由贷方设定。私人学生贷款通常比联邦学生贷款更贵。

Compare Federal and Private Student Loans

Schedule a Financial Aid Counseling Appointment

Important!

If you have lost your federal aid eligibility due to past unsatisfactory academic progress, you do have the option to request reinstatement of your eligibility by submitting a Satisfactory Academic Progress appeal.Appeal Formsare available online.

Private Loan Lenders

The Financial Aid Office at Eastern Oregon University does not endorse, recommend, or promote any lender selection for private loans.

The lenders and loan options presented inFastChoice包括过去在学校提供过贷款的贷方。

快捷选择在用户友好的网站上为学生和家长提供清晰、一致的贷款选项,并通过借贷必需品为学生提供教育。FastChoice是免费的,并得到了联邦贷款服务公司Great Lakes的全力支持。

You are free to choose any lender, including those not presented in FastChoice. If you choose a lender that is not presented, please contact the Financial Aid Office. Application processing will not be delayed unnecessarily if you choose a lender not presented.

Want to find your own lender?

Questionsto ask lenders when searching for alternative or private student loans.

- 你们借给东俄勒冈大学的学生吗?世界杯英格兰vs伊朗实时比分

- Do I need to be a member of a credit union to apply at a credit union?

- What are your repayment terms (e.g. 10 years, 15 years, up to 25 years)?

- Do you have repayment incentives?

- Do you have interest rate reductions with automatic payments? What are they?

- Do you have interest rate reductions for on-time monthly payments? How many consecutive months?

- Do you defer principal and interest during the school year, pay only interest during school, or pay principal and interest immediately?

- Do you have flexible repayment options? What are they?

- 你有延期和宽限的选择吗?他们是什么?

- What are the loan amounts?

- Do you have an annual minimum?

- What is your aggregate maximum?

- What is the interest rate? Is it fixed or variable?

- 利率是怎么计算的?

- Are there any fees?

- 如何评估费用?

- Can I get a loan without any fees?

- How much will this loan cost in total?

- 我是否需要保持令人满意的学业进展?

- Do I need to be at least a half-time student?

- 我需要有一个信用良好的联合签署人吗?

- None, with approved credit?

- Yes, depending on credit rating?

- If I’m approved without a cosigner, can my interest rate be lowered if I get a cosigner?

- Are there cosigner release benefits?

- Will my alternative education loan be sold to another lender at any time?

- 如果我的贷款被出售,购买贷款的贷方是否会给予还款奖励?

- What will my monthly payments be?

- 它们是否会根据贷款金额和贷款利息的不同而有所不同?

- Is there a grace period?

- Other things to consider when selecting a lender:

- What kind of upfront discounts do they offer?

- What can youafford?

- Understand the ultimate cost of the loan over its lifetime. Compare annual percentage rates (APR) versus interest rates and fees to determine the real cost of the loan.

- Be aware of what the monthly payments will be after graduation or leaving school and how that will affect your lifestyle after college.

- 了解贷款人的客户服务。你可能会和他们在一起很长一段时间,和一个更容易工作的贷款人在一起会让你更容易接受。

- 当心针对学生的贷款骗局。

- 找出“借款人利益”对你真正意味着什么。每项福利是如何实现的,如何在整个偿还过程中保持?如果你没有按时付款,会发生什么?

- Are there forbearance or deferment options? Understand what additional cost these may have for you.

- How does the lender capitalize interest (for example, after repayment begins or quarterly)?

- 地址、姓名或还款问题的任何变化都要通知你的贷款人——缺乏沟通是拖欠还款的第一步。

- 借款人应该首先选择联邦贷款,因为替代学生贷款可能会有更高的利率和费用。Federal Student Aidcan help you compare the two options.

- Please note that lenders offer better interest rates to borrowers who have a qualified cosigner.

- 法学和研究生可能会发现,贷款机构有专门为他们的研究领域设计的替代贷款。

Our officials are prohibited from accepting any financial or other benefits in exchange for displaying lenders and loan options in FastChoice. Prohibited activities include: receiving compensation to serve on any lender board of directors or advisory boards; accepting gifts including trips, meals, and entertainment; allowing lenders to staff our institution’s financial aid office; allowing lenders to place our institution’s name or logo on any of their products; and owning of lenders’ stock (for college officials who make financial decisions for our institution).

当你的贷款获得信贷批准并在本票上签字后,你的贷款申请将被转至EOU财务援助办公室。卡塔尔世界杯比赛对阵表您的贷款人将为您提供当前的利率,处理费用和联合署名要求。有关贷款资格的问题,请与卡塔尔世界杯比赛对阵表财务援助办公室联系。

Self-Certification Information

Private loan borrowers should be aware of two important changes established by the Truth in Lending Act (TILA)15 USC § 1638(e), both of which will affect the time required to apply for, and receive, a private student loan:

- Self-Certification form: As of February 14th2010年,当学生申请私人学生贷款时,贷款人需要从学生那里收集自我证明表格。该表格将在在线过程中提供,或贷款人将邮寄纸质副本给学生。请注意:私人贷款资金将不会支付,直到贷款人收到自我证明表格。

- Delays in disbursement: After the lender has received the Self-Certification form from the student, and the loan approval from the EOU financial aid office, they will send the student a Final Disclosure which details the terms of the loan. The lender is required to wait up to 6 business days before disbursing the loan to the school. This delay was included in the TILA to give the student (or cosigner) time to cancel the loan after reviewing the terms of the Final Disclosure.

Financial Aid Office Code of Conduct

EOU Policy关于私人借贷者及其优惠禁止。

Code of Conduct for Financial Aid Professionals

- No action will be taken by financial aid staff that is for their personal benefit or could be perceived to be a conflict of interest.

- 经济援助办公室的员工不会给自己或他们的直系卡塔尔世界杯比赛对阵表亲属提供援助。工作人员将把这项任务留给机构指定的人,以避免出现利益冲突。

- The University has no preferred lending agreement with any lender of private educational loans and does not maintain a preferred lender list. Neither the University nor any employee shall enter into any revenue-sharing arrangement with any lender or accept offers of funds for private loans to students in exchange for providing concessions or promises to the lender for a specific number of loans, a specified loan volume, or a preferred lender arrangement.

- 借款人对贷款人的选择不会被机构拒绝、阻碍或不必要地拖延。借款人不会自动分配给任何特定的贷款人。

- No amount of cash, gift, or benefit in excess of a de minimis amount shall be accepted by a financial aid staff member from any financial aid applicant (or his/her family), or from any entity doing business with or seeking to do business with the institution (including service on advisory committees or boards beyond reimbursement for reasonable expenses directly associated with such service).

- No compensation may be accepted for any type of consulting arrangement or contract to provide services to or on behalf of a lender relating to education loans.

- Information provided by the financial aid office is accurate, unbiased, and does not reflect preference arising from actual or potential personal gain.

- Institutional award notifications and/or other institutionally provided materials shall include the following:

- A breakdown of individual components of the institution’s Cost of Attendance.

- Clear identification of each award, indicating type of aid, i.e. gift aid (grant, scholarship), work, or loan.

- 标准术语和定义。

- Renewal requirements for each award.

- 所有必需的消费者资料均显示在机构网站和任何印刷材料的显著位置,易于识别和找到,并贴上“消费者资料”的标签。

- Financial aid professionals will disclose to their institution any involvement, interest in, or potential conflict of interest with any entity with which the institution has a business relationship.

Statement of Ethical Principles

机构财政援助专业人员的主要目标是通过提供适当的财政支持和资源来帮助学生实现他卡塔尔世界杯比赛对阵表们的教育目标。To this end, this statement provides that the financial aid professional shall:

Advocate for students

- Remain aware of issues affecting students and continually advocate for their interests at the institutional, state and federal levels.

- Support federal, state and institutional efforts to encourage students to aspire to and plan for education beyond high school.

Manifest the highest level of integrity

- Commit to the highest level of ethical behavior and refrain from conflict of interest or the perception thereof.

- Deal with others honestly and fairly, abiding by our commitments and always acting in a manner that merits the trust and confidence others have placed in us.

- Protect the privacy of individual student financial records.

- 促进思想和意见的自由表达,并促进对业内不同观点的尊重。

Support student access and success.

- Commit to removing financial barriers for those who want to pursue postsecondary learning and support each student admitted to our institution.

- Without charge, assist students in applying for financial aid funds.

- Provide services and apply principles that do not discriminate on the basis of race, gender, ethnicity, sexual orientation, religion, disability, age, or economic status.

- 了解财务教育的必要性,并致力于教育学生和家庭如何负责任地管理开支和债务。

Comply with federal and state laws

- 遵守所有适用的法律法规,管理联邦,州和机构的财政援助计划。卡塔尔世界杯比赛对阵表

- Actively participate in ongoing professional development and continuing education programs to ensure ample understanding of statutes, regulations, and best practices governing the financial aid programs.

- Encourage colleagues to participate in the financial aid professional associations available to them at the state, regional, or national level and offer assistance to other aid professionals as needed.

Strive for transparency and clarity

- Provide our students and parents with the information they need to make good decisions about attending and paying for college.

- 尽可能通过消费者测试的优质信息教育学生和家庭。这包括(但不限于)奖励通知的透明度和充分披露。

- Ensure equity by applying all need-analysis formulas consistently across the institution’s full population of student financial aid applicants.

- Inform institutions, students, and parents of any changes in financial aid programs that could affect their student aid eligibility.

Protect the privacy of financial aid applicants

- Ensure that student and parent private information provided to the financial aid office by financial aid applicants is protected in accordance with all state and federal statutes and regulations, including FERPA and the Higher Education Act, Section 483(a)(3)(E) (20 U.S.C. 1090).

- Protect the information on the FAFSA from inappropriate use by ensuring that this information is only used for the application, award, and administration of aid awarded under Title IV of the Higher Education Act, state aid, or aid awarded by eligible institutions.

- Note: The Higher Education Act does not allow us to share data from your FAFSA directly with certain outside agencies, even with your written permission.

*这部分采用了全国学生资助管理人员协会的道德原则声明和资助专业人员的行为准则。卡塔尔世界杯比赛对阵表本行为准则中的义务是州或联邦法律或东俄勒冈大学政策强加的要求之外的义务。世界杯英格兰vs伊朗实时比分